If you’re utilizing a payroll service or software program like QuickBooks Payroll, you possibly can automate most of this and save yourself lots of time. Plus, companies that monitor payroll prices effectively can really save money. In Accordance to the identical Intuit survey talked about above, companies that actively manage gross payroll prices save a median of 4.64%. If you’re a small enterprise proprietor, likelihood is good you’re the one handling payroll. Figuring out how to process payroll could be intimidating, however don’t worry.

Although the options differ by plan, all tax and payroll processing services integrate seamlessly with Intuit’s accounting software. As talked about earlier, opting for an automatic payroll system like QuickBooks can save time and reduce the trouble of managing payroll manually. In The End, this gives you extra time to give consideration to strategy, operations, and taking excellent care of your team. Quickbooks Payroll integrates seamlessly with in style small enterprise instruments like QuickBooks accounting software program, Outlook, Gmail and more. Key options to search for in payroll software program embrace correct tax calculations, simple report era, integration capabilities, and accessibility throughout devices. QuickBooks Payroll is an efficient payroll software alternative for so much of small businesses.

- Notably, Intuit outsources HR assist to a third-party firm, Mineral.

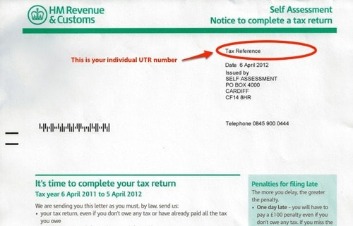

- If you aren’t sure, check your computerized tax payments and type submitting status first.

- In the rare moments he’s not working he’s normally out and about on one of numerous e-bikes in his assortment.

- The data offered is for instructional functions only and we encourage you to hunt customized advice from certified professionals regarding specific financial or medical choices.

After its initial success, it shortly added business products underneath the road QuickBooks, which has grown to what it’s at present. Whereas there are many pros and cons of QuickBooks Payroll, one factor stays the same – it’s well-known and well-regarded as a leading accounting and payroll program. If you already use different QuickBooks software program, you can see that QuickBooks Payroll integrates smoothly with all other QuickBooks programs. But as with giant programs, it prioritizes inner integrations above third-party integrations. The outcome, if you’re already a QuickBooks user, establishing QuickBooks Online Payroll will be a breeze. It will intuitively arrange and integrate along with your already current QuickBooks programs.

As Quickly As you’ve got all the information, it’s time for the calculation stage. You’ll calculate every employee’s gross pay primarily based on hours worked or salary agreements. Then, they apply mandatory deductions such as federal and state income taxes, Social Security and Medicare (FICA), and any relevant native taxes.

Maintain detailed and arranged payroll data as you process payroll, including https://www.intuit-payroll.org/ worker information, wage rates, tax withholdings, and benefit plan particulars. This ensures compliance with recordkeeping necessities and supplies documentation in case of audits or disputes. For occasion, the Age Discrimination in Employment Act (ADEA) requires employers to keep all payroll records for 3 years.

Our Hr Software Program Scores Methodology

We examined prices, tax companies, ease of use, customer service, integration options, and incentives like free trials and tax guarantees. We additionally appeared for cell accessibility, payroll report availability and employee self-service options. We learn buyer critiques and viewed Higher Enterprise Bureau scores and complaints to see how others view the vendor and its products. When looking for the best online payroll service for same-day direct deposit, we appeared for vendors with flexible direct deposit options alongside sturdy payroll and HR options.

For other plans, you should integrate payroll with Facebook’s Time Meter or any other time tracking app. QuickBooks Payroll is out there in all 50 states, however the Core and Premium providers include free tax submitting for one state only. QuickBooks Payroll Elite plan companies include free multi-tax state and federal tax submitting. QuickBooks Payroll routinely calculates payroll so that you don’t need to worry about tips on how to calculate payroll every month. All you want to do is enter the details of all of your employees, arrange payment guidelines and fix the day their payroll must run.

QuickBooks Payroll costs more than another suppliers within the business. For instance, Patriot’s most costly plan is $37 per 30 days, and its least expensive plan costs $17 per thirty days. If you haven’t got any budget to spend on payroll and solely want primary service, you can even pay your workers for free utilizing tools like Payroll4Free. Many companies already use QuickBooks for accounting; it’s widely recognized as one of the best business accounting software options obtainable. If you’re already in the QuickBooks ecosystem, QuickBooks Payroll may be a superb choice in your payroll needs.

How To Handle Contractors Remotely: A Guide For Us Businesses

Achieve useful enterprise insights with automated payroll reviews. Drill right down to view employee hours, earnings, taxes withheld, and extra. QuickBooks Payroll presents versatile pricing tailor-made to your small business needs, whether a small startup or a rising enterprise.

Three separate Payroll-only plans – Core, Premium and Elite – are available for $50, $88 and $134 per 30 days, however they lack bookkeeping. QuickBooks On-line customers can also add payroll at any time from their accounts. QuickBooks Self-Employed is the one QuickBooks accounting product that doesn’t combine with QuickBooks Payroll. If you’re using QuickBooks Self-Employed and need to start paying staff with QuickBooks Payroll, you’ll need to upgrade to a small-business QuickBooks On-line plan first. Like most payroll software program, QuickBooks Payroll includes a tax-filing accuracy assure with each plan. This assure signifies that QuickBooks Payroll pays any IRS fines incurred by a QuickBooks-caused drawback.

Nonetheless, the software is expensive compared to other choices in the marketplace. In addition to payroll processing, QuickBooks Payroll offers tools to manage worker benefits. It partners with SimplyInsured to supply workers medical, dental and imaginative and prescient protection. Premium deductions get routinely calculated and added to the payroll.